Many individuals, businesses or entities are situated outside India but they have certain incomes arising in India. For foreign nationals or businesses situated outside India, provisions of Double Taxation Avoidance Agreements(DTAA) are applied and to comply with the provisions of DTAA one form 10F of Income Tax is a requirement. Mainly, this Form 10F is a document used in India by non-resident taxpayers to claim benefits under a Double Taxation Avoidance Agreement (DTAA). The form provides information about the taxpayer’s residential status, which helps to establish that they are a resident of a country with which India has a DTAA.

Form 10 purpose and objects:

Form 10F is used by Non-resident taxpayers in India for following purposes:

- Establishing tax residency in absence of all the information TRC (Tax residency certificate):

To establish residency of a person is important to income tax so that he is held taxable in India for his income generation in India and not on the income he earned globally. Therefore, Form 10F also acts as proof of tax residency status with the Income tax authorities.

- DTAA Benefits:

DTAA are the agreements of India government with another country for monitoring tax transactions. By filing form 10F taxpayer claim the advantages offered by the DTAA between India and residence country.

The Form 10F requirement also allows non-resident taxpayers to claim tax exemptions and deductions on their income generated in India.

Form 10F Applicability:

Any person who wants to avail the benefits of DTAA must file a self-declaration in Form 10F along with a TRC of their country of residence. The Form 10F applicability is mandatory for NRIs who do not have all the required details of TRC. Fling Form 10F allows non-resident taxpayers to avoid TDS (tax deducted at source) on income accrued in India. For NRIs earning income in India is generally subject to TDS. Moreover, TDS is deducted at a higher rate if an individual does not furnish his PAN.

Form 10F is required to be filed by non-resident individuals, companies or other establishments. Foreign citizens working in India, freelancers or consultants providing services remotely, or individuals receiving income from investments made in India like dividends or interest have to file Form 10F.

Update: Electronic filing of Form 10F is mandatory, whether the NR possesses a valid PAN or not.

Documents required for filing of Form 10F:

- PAN Card

- Residence address proofs

- Duration of stay abroad as mentioned in TRC

- Status of taxpayer i.e. Individual or company etc.

- Unique Tax Identification Number

- TRC

How to File Form 10F Online:

Form 10F is filled electronically on the Income Tax Department’s e-filing portal. Let us understand how it is filed:

- Login to income tax portal

- In case registration is required to be done on income tax portal, the same has to be completed first

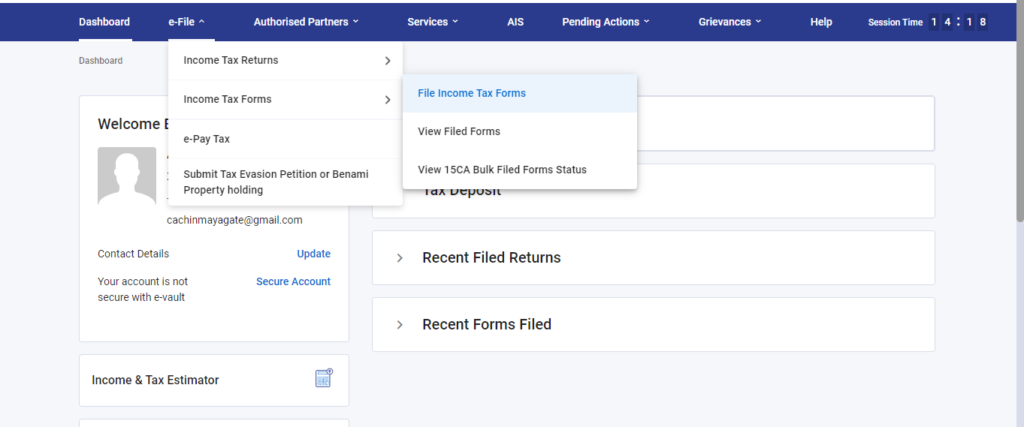

- After successful login, go to e-file tab on dashboard and select Income tax forms and click on file income tax forms

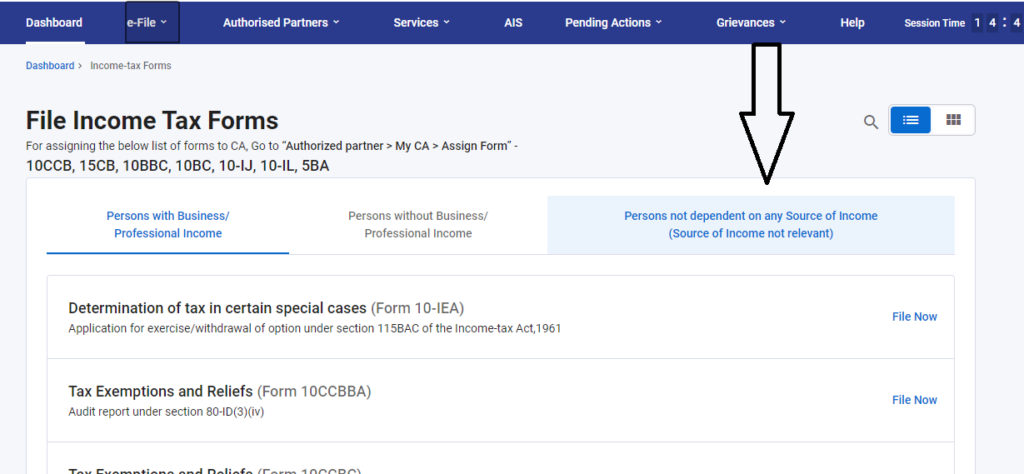

- Out of the three options presented on screen, choose the third option i.e. person not dependent on any source of income

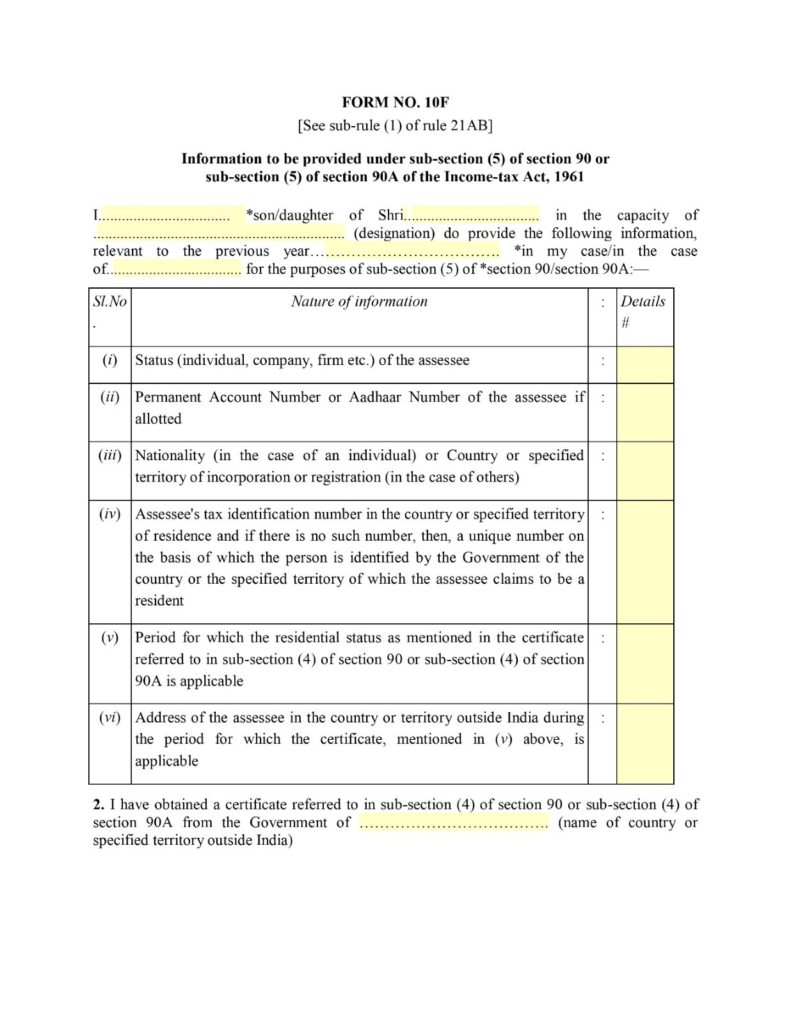

- Enter all the mandatory details as required which includes

- Basic personal details

- Authorised signatory for other than individual

- Details like relevant sections, residence country, TRC details, country and Tax Identification number etc.

- Contact information and address outside India during the TRC validity period.

- Upload TRC and other required documents.

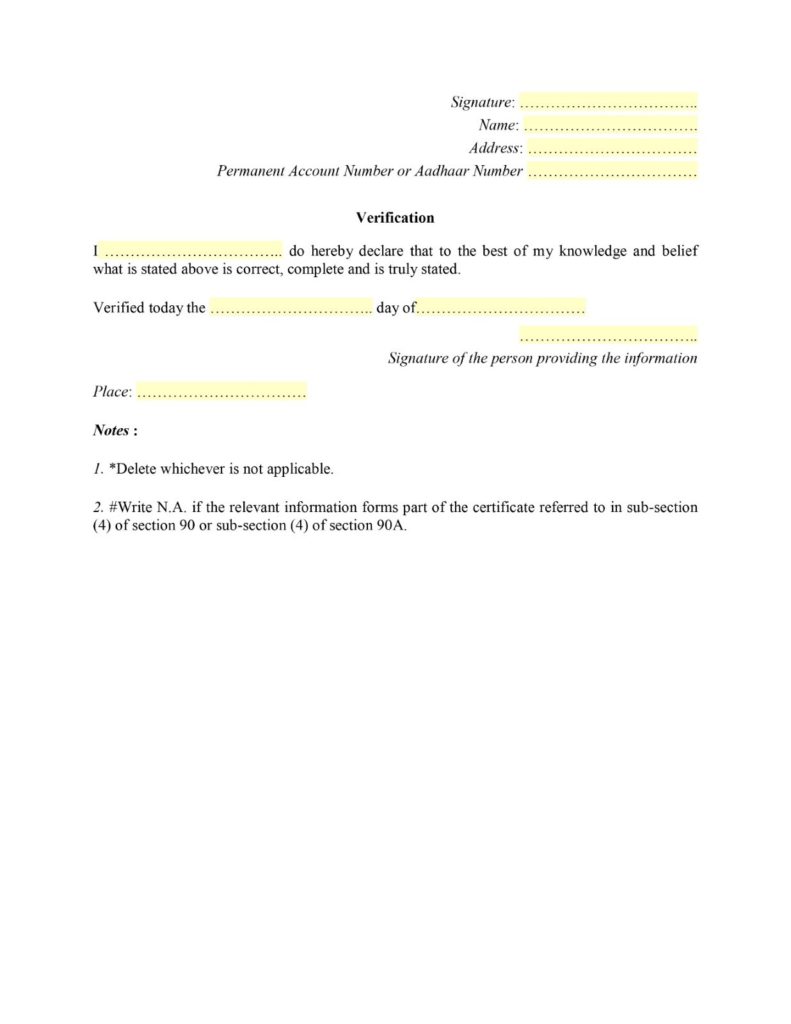

- This follows a verification and submission process online where the form is submitted and an acknowledgement is generated.

The Form 10F is necessary to claim the benefits of India’s DTAA with foreign countries. Non-compliance with the Form 10F requirement will result in the withdrawal of DTAA benefits given to a taxpayer. A higher rate of TDS is applicable to those who have not filed this form.

Attached here is a preview draft of Form 10F:

Advantages of Filing form 10F:

- Lower rate of Tax: No higher rates of tax on income derived in India like dividends, interest, and royalties.

- Additional evidence of residency: This strengthens the TRC validity as it acts as supporting evidence.

- Better tax compliance: Since filing form 10F is a mandatory requirement, its timely submission ensures no benefits of DTAA remains unclaimed.

Conclusion:

Filing Form 10F is a crucial requirement for non-resident individuals or companies, to claim relief or benefits under double taxation avoidance agreements when earning income within and outside India. This form ensures compliance with tax regulations and facilitates the applying lower rates of taxes. It’s essential to file Form 10F accurately and timely to maximize tax benefits and avoid legal consequences.

CA Chinmay Shirish Agate

Chinmay Agate is a Practicing Chartered Accountant having 4+ years of experience and expertise in the field of Direct Taxation and Auditing compliances. In the past, he worked in various CA firms and comes with wide industry experience from services, retail to manufacturing to trading where he has handled various complex assignments. He has keen interest in Forex and Derivative knowledge as well as fundamental analysis.

Recent Comments