1. Enter a Call back request through software

2. To speak to our Helpline representative, Call on 020 4909 1000

3. To escalate, call on 082750 18929

4. To escalate further, send mail at crm@sinewave.co.in

5. Not satisfied with the support provided, What’s App the customer Id and issue on 096377 69351 (Executive Assistant/Director’s Office)

Thank you for being associated with us. We are always here to help you in any way we can.

India’s Best ITR, TDS, GST Software For Your Business!

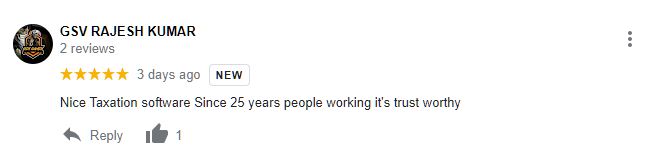

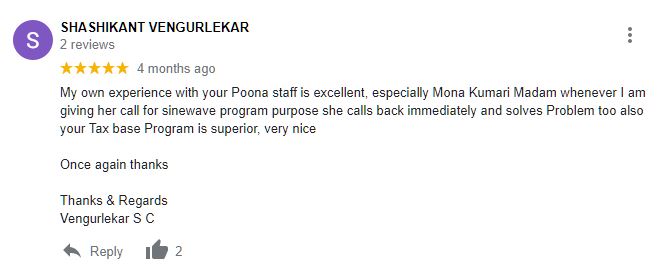

Sinewave is among the top-notch tax software companies in India. Working for 36 years we are proficient in producing reliable, consistent, and high-quality income tax, TDS, and GST software for our clients. By offering advanced technology services, we aim to assist people. With a focus on transforming tax computation, and filing Sinewave have been developing taxation software products for the Indian market we have a successful clientele of 30,000.

Excellent Income Tax Software

Exceptional tax preparation and calculation software that embraces TDS, Income Tax, PF, ESIC, and Professional Taxes.

High Quality Taxation Products

A well-known name in the business, Sinewave provides high-quality and reliable GST, TDS, Income Tax, and Payroll software.

Wide Range of Clientele

We work with a variety of clients including CAs, Cost Accountants, Tax Consultants, Education Institutes, Co-operative Societies, Banks, Service Industries, Small and Medium Businesses (SMEs), and many others.

Tax Software with Many Features

Our Taxation software offers numerous features like computation of Income Tax, TDS, Advance Tax Register, Billing Management, AIR modules, Office Management, and Post filing management at no extra cost.

Trusted Tax Software Company in India

35+

Years of Experience

30,000+

Happy Customers

10+

Presence in States

Our Tax Software and Products

By combining the talents of our software developers, we produce the most reliable income tax, TDS, and GST software for our clients, thus making us the most trusted tax software provider in India. Sinewave offers the best income tax e-filing software, TDS and GST preparation, tax computation software, HR management software, Payroll management software, and most importantly Digital Signature software.

ITR Software

TaxbasePro – This ultimate income tax software includes all the functions of a tax return as well as electronic filing, making it user-friendly, well-designed, and professional.

TDS Software

TDSPro – High-quality TDS software designed by professionals of Sinewave aids to determine TDS payments. Super user-friendly with accurate results.

![]()

GST Software

The advanced Taxbase GSTpro facilitates with its eye-catching features like, GST returns filing, return dashboard, input credit registers, and inward/outward supplies invoicing.

VAT Software

VATXpress – Professional VAT/MVAT software designed to compute VAT, E-payments, and E-filings. Helps businesses utilize customer-facing transactions.

TaxbaseSigner

Software that offers digitally signed documents and other high-end features. Easily manage bulks, logos, positions, etc. Accommodated and enforced across most industries.

Payroll Software

Paywhiz – A versatile employee payroll management software combined with taxation. Specially designed for MNCs, banks, BOPs, SMEs, and other instructions.

![]()

Team Management Software

TeamControl – team management software is a must-have for your organization. It manages team participation, attendance, designations, departments, and monthly summary.

Few of Our Happy Clients!

Available at a click

Get your portfolio valuation in real time

• Returns at script level

• Portfolio returns for an individuals and group of individuals

• Import data from MOS into Taxbase wherein Capital Gains and taxes thereon are self computed

Why choose us?

Sinewave is one of the most trusted taxation software provider companies in India with more than 30,000 clients. Our team of professional software designers and developers is skilled in making the best ITR, TDS, GST, and accounting tax software for all organizations including banks, SMEs, offices, firms, business organizations, and educational institutions.

Unlike our competitors, we provide much more than just taxation software, like workflow management, DSCs, employee payroll management, GST software, VAT software, and many other TDS software programs.

Invest in Sinewave software and let your business flourish..!