What is Form 10E for Relief under Section 89(1)

Tax planning is one of the main financial compliance every person earning income must undertake primarily at the beginning of the financial year. It can sometimes seem like an intricate puzzle, with various rules and provisions governing how income is taxed. Section 89(1) of the Income Tax Act, 1961, includes provisions that provides relief to taxpayers who receive salary arrears or advance salary belonging to multiple financial years in a single year. This section aims to ensure that individuals are not unfairly taxed on income that they have received for past years, thereby preventing double taxation or undue tax burden. To claim such benefits, a Form 10E of income tax needs to be filed.

What Is Relief under Section 89(1)?

As per provisions of income tax, tax is calculated on the income received during the respective financial year. However, if any income received during the year includes any income belonging to the previous years then a question arises as to which tax rate will apply to such income. To tackle this issue income tax act has provided taxpayers with relief under section 89(1). If you have received any amount of your salary in arrears or in advance, or there are arrears of family pension, then a tax relief under Section 89(1) is granted. Arrears of salary may also include components such as bonuses, commissions, or other forms of compensation. Now, a question arises of how to calculate amount of tax relief under section 89(1).

To calculate the relief amount, first income is taxed as per the rates of that respective years considering as if the income is earned in those years itself. The difference between the aggregate tax payable and the sum of taxes payable for each year is then calculated, and relief is granted accordingly.

What is Form 10E?

It’s essential for taxpayers to submit Form 10E within the specified timeframe to avail of the relief under Section 89(1). Failure to do so may result in the denial of relief or additional tax liabilities. individual taxpayers, including salaried employees, pensioners, and recipients of family pensions, who receive salary arrears, advance salary, or lump sum payments spanning multiple financial years are supposed to submit this Form 10E before filing income tax return for the concerned financial year.

Here are some important aspects for filing form 10E:

- Form 10E online before filing your income tax return.

- While arrears on salary may pertain to earlier financial years, you must choose the Assessment Year in which you have received the arrears while filling out Form 10E.

- There is no tax relief under Section 89(1) for VRS (Voluntary Retirement Scheme) compensation if you have previously claimed tax exemption on the same under Section 10(10C).

Procedure to file form 10E using taxbase software:

Taxbase has made filing forms easier than before. Once you fill entire income details in your profile from software then you will have to follow the process mentioned below:

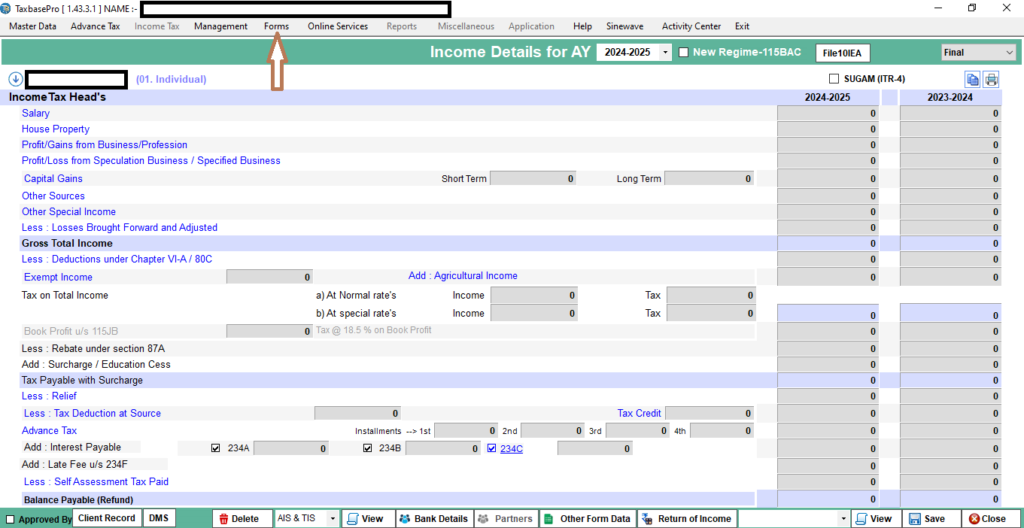

- Open Forms option from the tab:

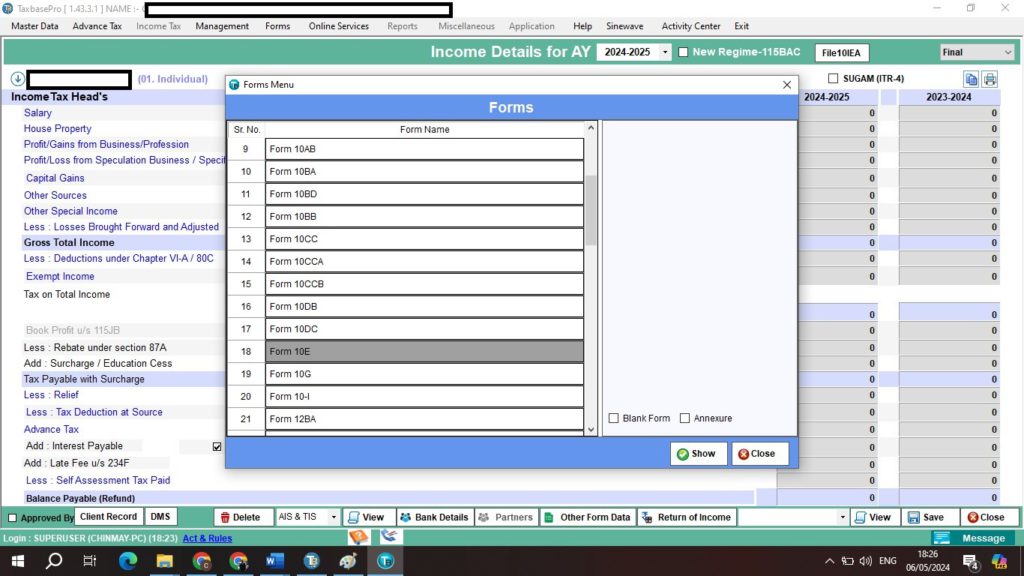

- In case you have filled all your salary and arrears details you will have to open form 10E as shown below by double clicking on the same:

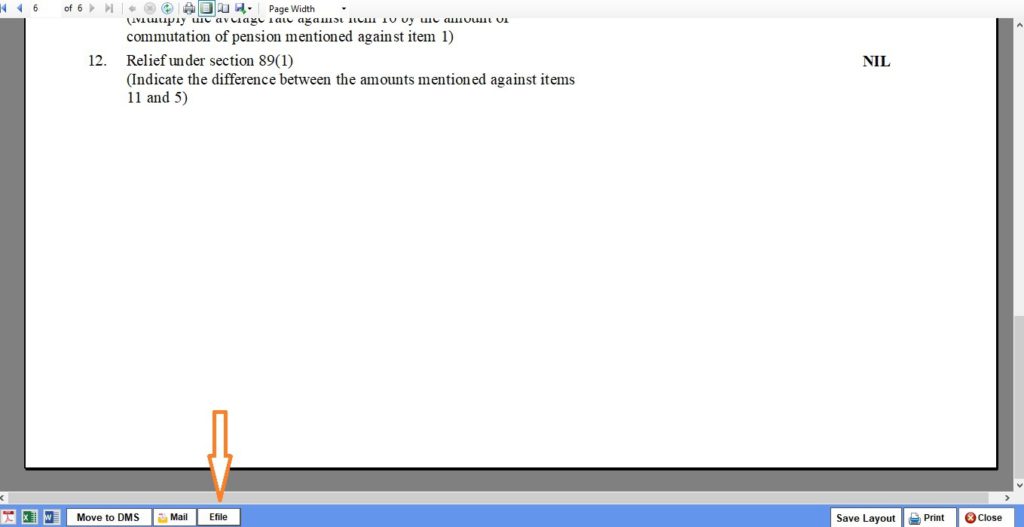

- Once you have completed this step, then an auto populated pre-filled form 10E will open including all the information as mentioned in the income details. At the end of this form you will find an option to e-file the form which will redirect you to the income tax portal for filing the form.

Conclusion:

By spreading the tax liability over the relevant years, section 89(1) helps alleviate the financial burden on taxpayers and promotes equity in the tax system. Salaried individuals are saved from double taxation as well no higher rates of taxes are applied on the income earned in the form of salaries or pensions pertaining to previous years.

Form 10E Relief under Section 89(1) of the Income Tax Act, 1961, provide much-needed relief from double taxation or excessive tax burden, this provision empowers taxpayers to navigate through complex tax situations with confidence. Form 10E Relief is important for taxpayers facing issue where salaries or pension income received in a particular assessment year includes incomes from multiple financial years.

About Author:

CA Chinmay Shirish Agate

Chinmay Agate is a Practicing Chartered Accountant having 4+ years of experience and expertise in the field of Direct Taxation and Auditing compliances. In the past, he worked in various CA firms and comes with wide industry experience from services, retail to manufacturing to trading where he has handled various complex assignments. He has keen interest in Forex and Derivative knowledge as well as fundamental analysis.