Section 133(6) Notice of Income Tax Act

Income Tax return filing season has just started, and taxpayers are gearing up with all the required information to be reported in their tax returns. Income tax authorities have issued notices in previous financial year to taxpayers who have underreported or misreported their actual income. Income tax notices for underreporting or misreporting typically occur when the tax authorities suspect discrepancies between the income reported by a taxpayer and the income that should have been reported according to their records.

Taxpayers must keep in mind that providing all the financial information to the income tax department is crucial to avoid any kind of suspicion form department which may ultimately result in getting notices from them.

What is Section 133 (6) of the Income Tax Act?

Section 133(6) of the Income Tax Act, 1961, grants the tax authorities the authority to gather information from various sources to ensure compliance with tax laws and to prevent tax evasion. Income tax authorities posses the power to summon any person to obtain from him any kind of additional information or evidences as required for any purpose, where they feel that a particular income might have been underreported, misreported or omitted from reporting.

Under section 133(6), Assessing Officers, Deputy Commissioners (Appeals), Joint Commissioners, and Commissioner “Appeals” counterparts can all send these notices independently. In certain cases approval from certain higher authorities are required if notices are being sent by anyone below the ranks of Principal Director, Director, Principal Commissioner, or Commissioner (excluding Joint/Deputy/Assistant Directors).

Under section 133(6) anyone can be summoned by these above mentioned authorities. This means that not just taxpayers but also banks, financial institutions or any other authorities are also liable to respond to such notices.

How to respond to notice U/S 133 (6)?

Once any person receives notice under section 133(6), it is important to read all the facts mentioned in such notices. Any delay or misinterpretation of such notice may land a person in legal actions or even imposition of penalties. Also, there should not be any delay in submitting the response to such notice. Let us understand the step by step process to respond to such notices.

- Understanding the facts mentioned in notice u/s 133(6):

Person responsible for replying to such notice is required to gather all the necessary information before drafting any reply to the notice.

- Login to Income Tax Portal:

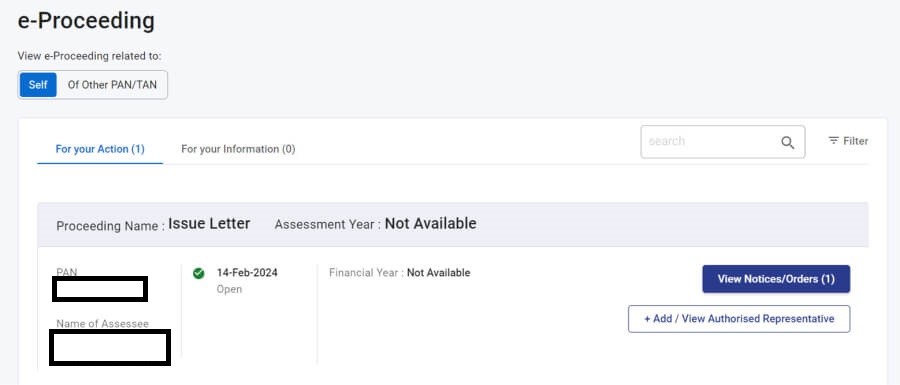

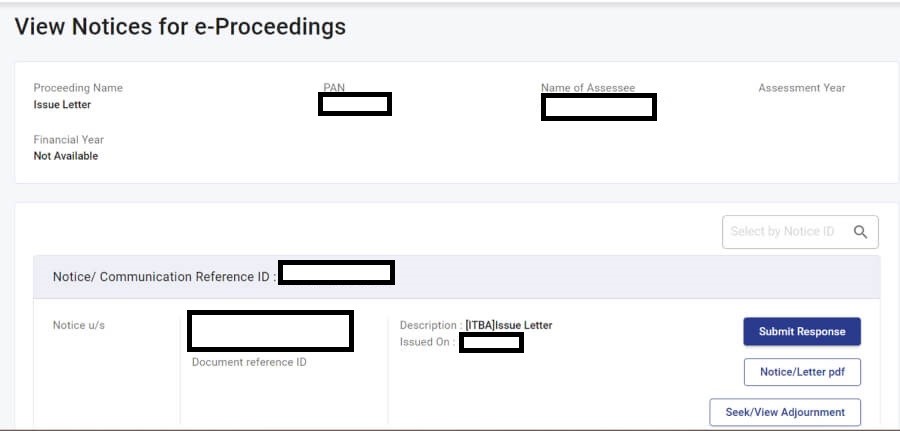

To respond to these notices, taxpayer has to login to his income tax profile and proceed to respond under tab “Pending Actions”>”e-proceedings”.

Here you can view the notices you are supposed to respond.

- Fill the required information:

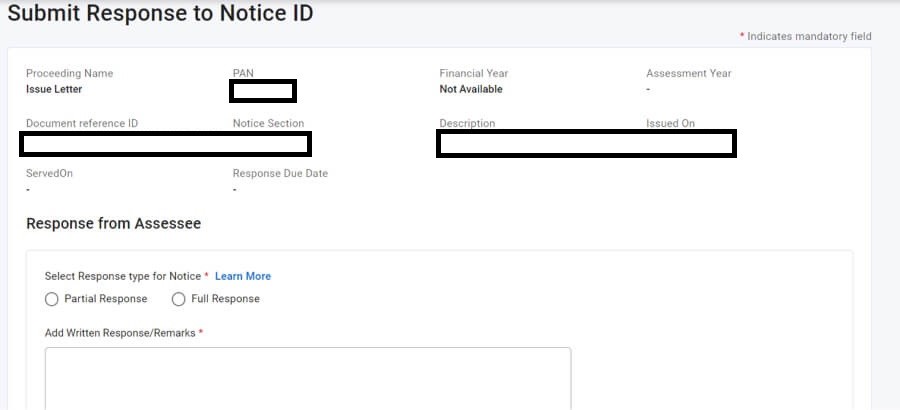

After opening the pending notices in the income tax portal you will be given the option to submit the response. You may choose to submit a partial or Full response. After entering all the necessary information, the reply must be submitted.

Non-compliance consequences:

If a person fails to submit proper response to such notices, then penal provisions are attracted and following consequences may occur to the person in default:

- IT Return getting invalid or defective

- Revised return to be filed disclosing all the undisclosed incomes and withdrawal of exemptions or deductions

- Penalty of Rs.100 per day till the date of completion of compliance under section 272A(2) of Income Tax Act, 1961.

Conclusion:

It’s essential for the recipient of the notice to respond promptly and provide accurate information to the best of their knowledge. The action from Income Tax department depends on the specific circumstances of the case and the information provided by the recipient. It’s crucial for the taxpayer to cooperate fully with the tax authorities and ensure timely and accurate responses to avoid any adverse consequences. Any default in replying to such notices may land the taxpayer or the concerned person in trouble involving legal actions and penal proceedings.

About Author:

CA Chinmay Shirish Agate

Chinmay Agate is a Practicing Chartered Accountant having 4+ years of experience and expertise in the field of Direct Taxation and Auditing compliances. In the past, he worked in various CA firms and comes with wide industry experience from services, retail to manufacturing to trading where he has handled various complex assignments. He has keen interest in Forex and Derivative knowledge as well as fundamental analysis.