ITR 1 and ITR 4 changes for AY 2025-26

Ques: What are the changes for ITR 1 & ITR 4 for AY 2025-26?

Ans: Below are the major changes for ITR 1 & ITR 4 for AY 2025-26:

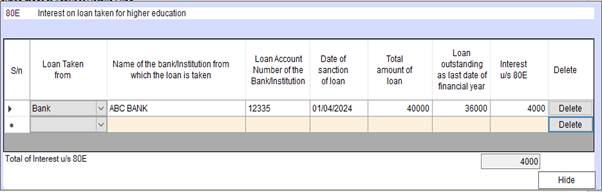

- Section 80E: Interest on Loan taken for higher education

As per changes in Government Utility, it is now mandatory to report details of loan taken for higher education like name of the bank/institution, loan account number, loan amount etc.

Hence, New schedule has been added for data entry:

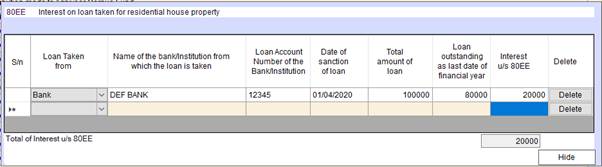

- Section 80EE: Interest on loan taken for residential house property

As per changes in Government Utility, it is now mandatory to report details of loan taken for residential house property like name of the bank/institution, loan account number, loan amount etc.

Hence, New schedule has been added for data entry:

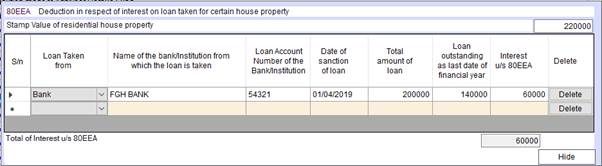

- Section 80EEA: Interest paid on home loan for affordable housing

As per changes in Government Utility, it is now mandatory to report details of loan taken for affordable housing like name of the bank/institution, loan account number, loan amount etc.

Hence, New schedule has been added for data entry:

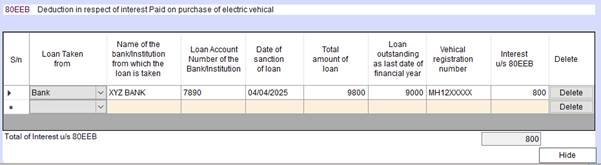

- Section 80EEB: Interest paid on loan taken for the purchase of electric vehicles

As per changes in Government Utility, it is now mandatory to report details of loan taken for the purchase of electric vehicles like name of the bank/institution, loan account number, loan amount etc.

Hence, New schedule has been added for data entry:

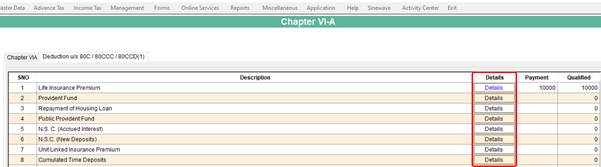

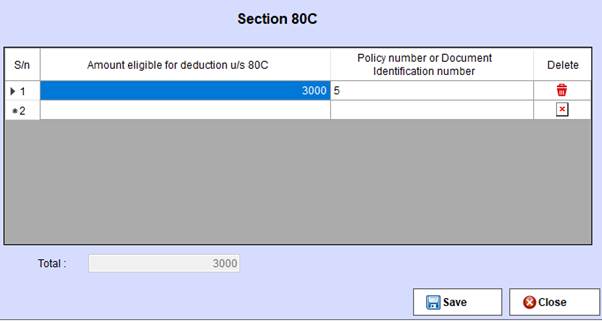

- Section 80C: Deduction in respect of life insurance premium, deferred annuity, contributions to provident funds, subscription to certain equity shares or debentures, etc.

As per changes in Government Utility, it is now mandatory to report details like amount of deduction and Policy Number or Document Identification Number

for all deductions claimed u/s 80C.

Hence, New table has been added for data entry:

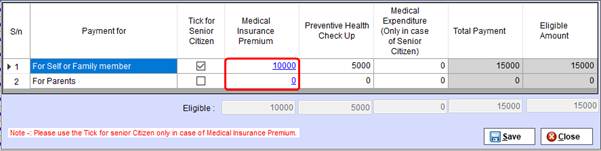

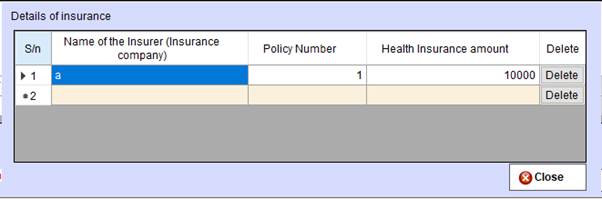

- Section 80D: Deduction in respect of Medical Insurance Premium

As per changes in Government Utility, it is now mandatory to report details of insurance like Name of Insurance Company, Policy Number, Insurance amount etc.

Hence, New table has been added for data entry under Medical Insurance Premium:

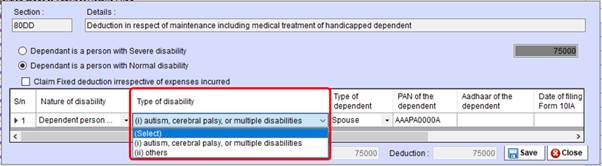

- Section 80DD: Deduction in respect of maintenance including medical treatment of handicapped dependent

As per changes in Government Utility, it is now mandatory to report details of

type of disability of dependent person against whom the deduction is being claimed.

Hence, New column ‘Type of disability’ is added:

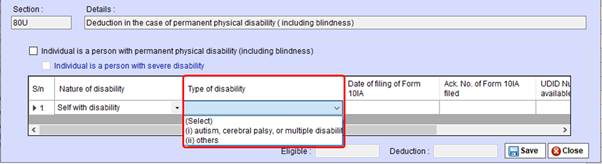

- Section 80U: Deduction in the case of permanent physical disability (including blindness)

As per changes in Government Utility, it is now mandatory to report details of

type of disability of dependent person against whom the deduction is being claimed.

Hence, New column ‘Type of disability’ is added:

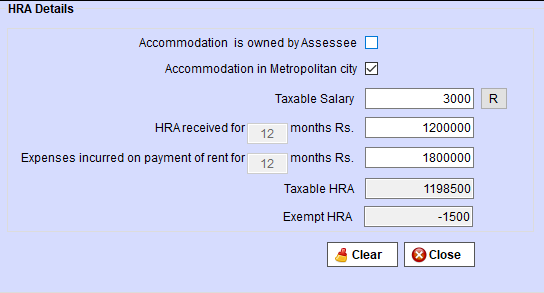

- Section 10(13A): House Rent Allowance

As per changes in Government Utility, separate schedule 10(13A) has been added for HRA exemption. Taxpayers should fill details like Salary (Basic + D.A.) ,HRA received, rent paid and other details in this schedule.

Note: Allowance to meet expenditure incurred on house rent has been removed from the list of allowances exempt u/s 10 and data entry option is provided in this schedule only.

Hence, New schedule has been added:

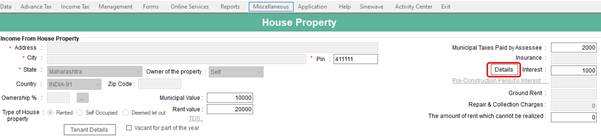

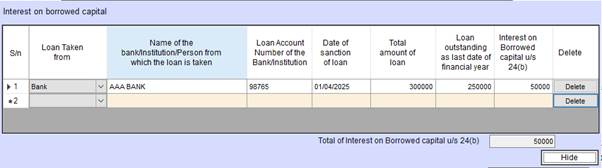

- Section 24B: Interest on Borrowed Capital

As per changes in Government Utility, separate schedule 24B has been added for Interest on Borrowed Capital. It is now mandatory to report details of loan taken for house property like name of the bank/institution, loan account number, loan amount etc.

Hence, New table has been added for data entry in ‘Details’ button:

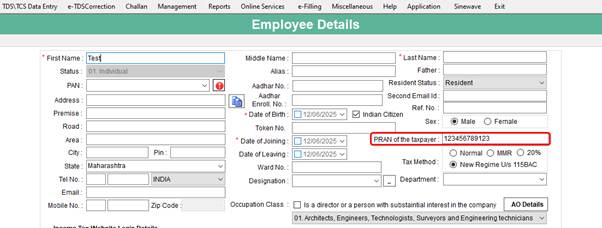

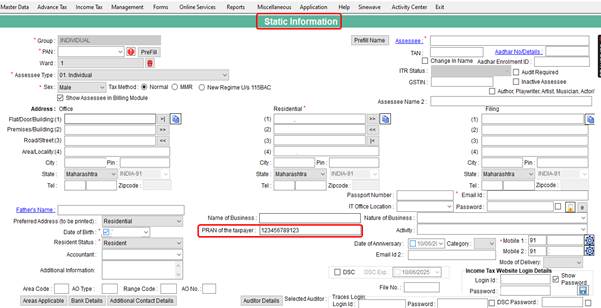

11. PRAN No: PRAN stands for Permanent Retirement Account Number. It’s a unique 12-digit identifier assigned to each NPS subscriber. As per Government Utility it is now mandatory to enter PRAN no. for assessees claiming deduction under 80CCC/80CCD(1)/80CCD(1B).

- In Application Taxbase, New field has been added in Static Information:

- In Application TDS, New field has been added in Employee Definition: