Explanation of Press Release on Implementation of E-Verification Scheme-2021

In India, many people are not aware about their eligibility and liability to file the Income Tax Return and hence they end up either not filing the ITR or under reporting the income that is subject to be reported on the Income Tax portal. There are cases where people have filed their ITR and forgot to verify the same either through e-verification option or by sending manually signed copies through post or speed post to Income Tax Department. This not verifying the ITR is considered as equal to non filed ITR.

Many times taxpayers and return filers forget to report certain incomes and transactions which needs special reporting on the website. Manly incomes like interests and dividends escape the reporting in the ITR.

Hence, to tackle this issue Income Tax Department has come with a new E-Verification Scheme called E-Verification Scheme – 2021. Let us delve deeper into what the department has planned for people who receive these notices of incomes mismatch between IT portal and Return filed.

E-Verification Scheme – 2021:

Income Tax Department has identified certain mismatches between the information received from third parties on interest and dividend income, and the Income Tax Return (ITR) filed by taxpayers. In many cases, taxpayers have not even filed their ITR. This scheme is specially focused on the mismatch of interest and dividend income for AY 2022-23 and AY 2023-24.

This scheme deals with mismatch in interest and dividend income between AIS/TIS and return filed or on filed return where the income from interest and dividend is reported in the Income from Other Sources column.

Taxpayers are soon going to receive this mismatch alert through E-mail and SMS facilities in cases where this mismatch appears.

How to respond or reconcile this mismatch?

In order to reconcile the mismatch, an on-screen functionality has been made available in the Compliance portal of the e-filing website https://eportal.incometax.gov.in for taxpayers to provide their response. At present, the information mismatches relating to Financial Years 2021-22 and 2022-23 have been displayed on the Compliance portal. The taxpayers are also being made aware of the mismatch through SMS and emails as per details available with the Department.

One important thing we need to understand here is that this mismatch alert being shown in AIS or compliance portal is not an Income Tax Notice but the failure to respond to this alert may result in assessee receiving a notice from the department. Hence, it is advisable that the assessees who receive such alerts do respond to these alerts within prescribed time limit.

There will be two types of assessees receiving such mismatch alerts and both of them are required to respond. Firstly, those assessees who have not registered themselves on the portal and hasn’t filed ITR and secondly those who have filed ITR and a mismatch alert is received.

Taxpayers who have already registered on the e-filing portal:-

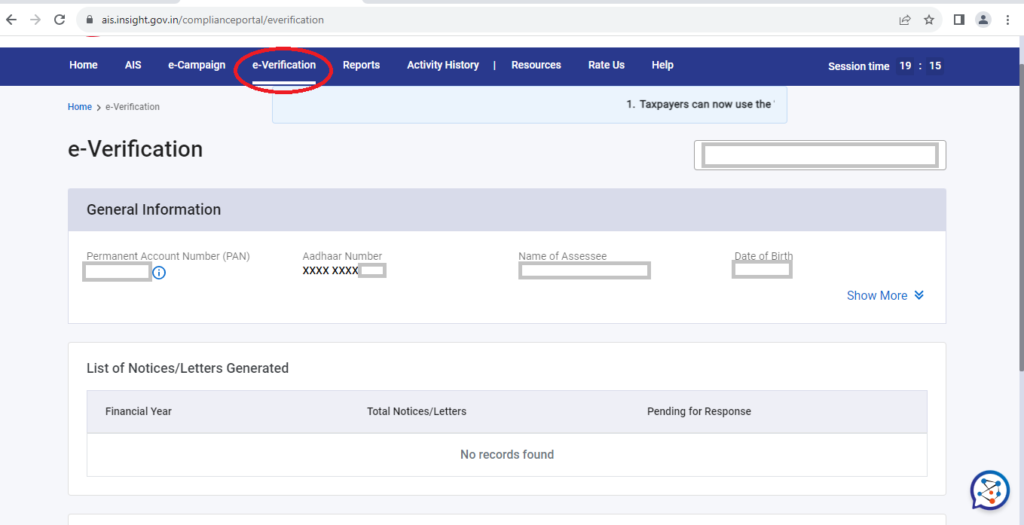

Those taxpayers who have already registered on the e-filing website, can navigate to Compliance portal directly after logging into their account. Details of mismatches identified will be available under the “e-Verification” tab.

Taxpayers who have not registered on the e-filing portal:-

Taxpayers who are not registered on the e-filing website have to register themselves on the e-filing website to view the mismatch. For registration, the “Register” button on the e-filing website can be clicked and the relevant details can be provided therein. After successful registration, the e-filing account can be logged into and the Compliance portal can be navigated to view the mismatches.

Let us understand, where to find these alerts on the e-filing portal and solution to respond to them:

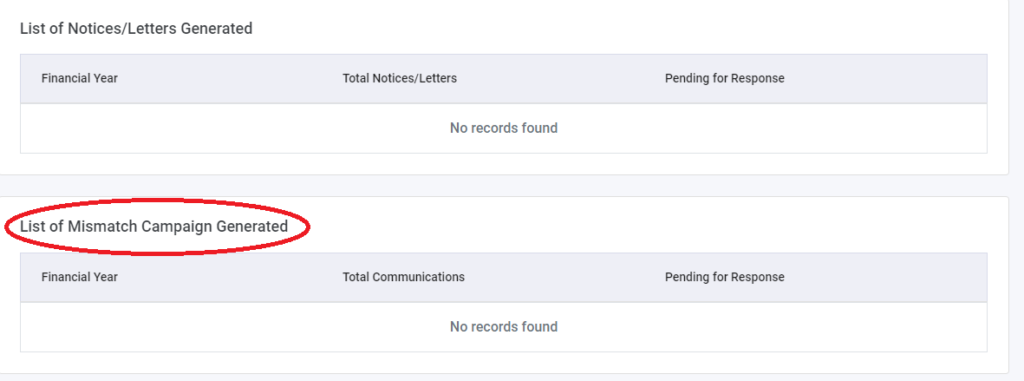

Assessee who has received the alerts of mismatch first have to login in his income tax portal and them open the AIS tab on the dashboard toolbar. Once you open the AIS compliance portal, find e-verification tab as disclosed in the above image. In the e-verification tab of AIS compliance portal you will find a section where list of mismatch campaign will be reported. These will be the mismatch alerts that you need to respond.

In reconciliation, the assessee primarily has three options to submit their response in the prescribed manner. These are:-

1. Provide Feedback in AIS where the mismatch alert is showing:

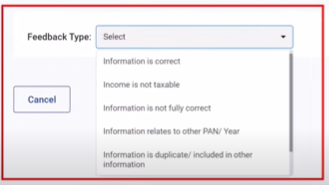

If the assessee wishes to change the information appearing in the AIS he may do so by selecting the options available in the feedback tab as shown below:

Selecting any option would open the window to provide further explanation and assessee will have to enter those details. The most important thing to be kept in mind while providing feedback in AIS that do not give wrong feedback or wrong information in the AIS update.

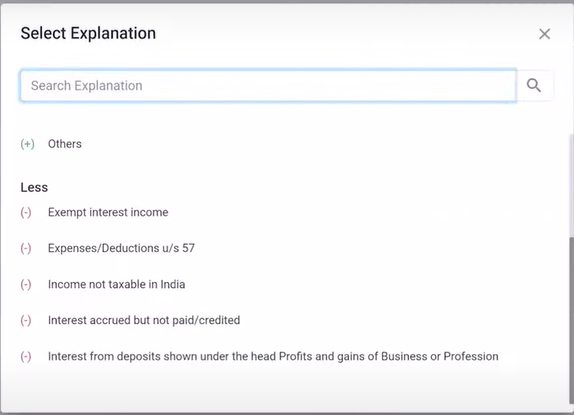

2. Provide explanation regarding the mismatch alert in the compliance portal:

The compliance portal provides the option to assessee for giving explanation of the difference in AIS value and the value reported in ITR. Income Tax Department has allowed five parts of explanation to be given in responding to the mismatch alert campaign. Following are the five point where explanation is allowed to be given:

3. File updated Return of Income:

In case if the above two options are not in favour of the assessee then he is left with the option to File ITR U to report the income that has escaped reporting in the original ITR.

Exception to respond in certain cases:

If a taxpayer has reported the interest and dividend income in “Others” line of head of income for “Income from other sources” instead of showing it in “Interest, dividend etc.” line then it is not required to respond to the mismatch pertaining to the interest income. The said mismatch shall be resolved on its own and will be reflected in the Portal as “Completed”.

Conclusion:

The on-screen functionality is self-contained and will allow the taxpayers to reconcile the mismatch on the portal itself by furnishing their response. Taxpayers have an option to update any information they think of updating through AIS and any mismatch alerts can hence be resolved through the portal itself without furnishing any additional documentation. This is a pro-active step taken by the Department to reach out to the taxpayers and provide them an opportunity to respond to the communication in a structured manner. It is clarified that the said communication is not a notice. This initiative by Income Tax Department will ensure that no income reporting is escaped and there is transparency in the financial reporting segment.