Introduction:

Income tax department have made their intentions clear in Union Budget 2023 to make new tax regime as default regime to file Income Tax Returns of all kinds of taxpayers. Earlier old tax regime was the default regime to file income tax returns and taxpayers had to opt for new tax regime by filing a declaration in Form 10 IE.

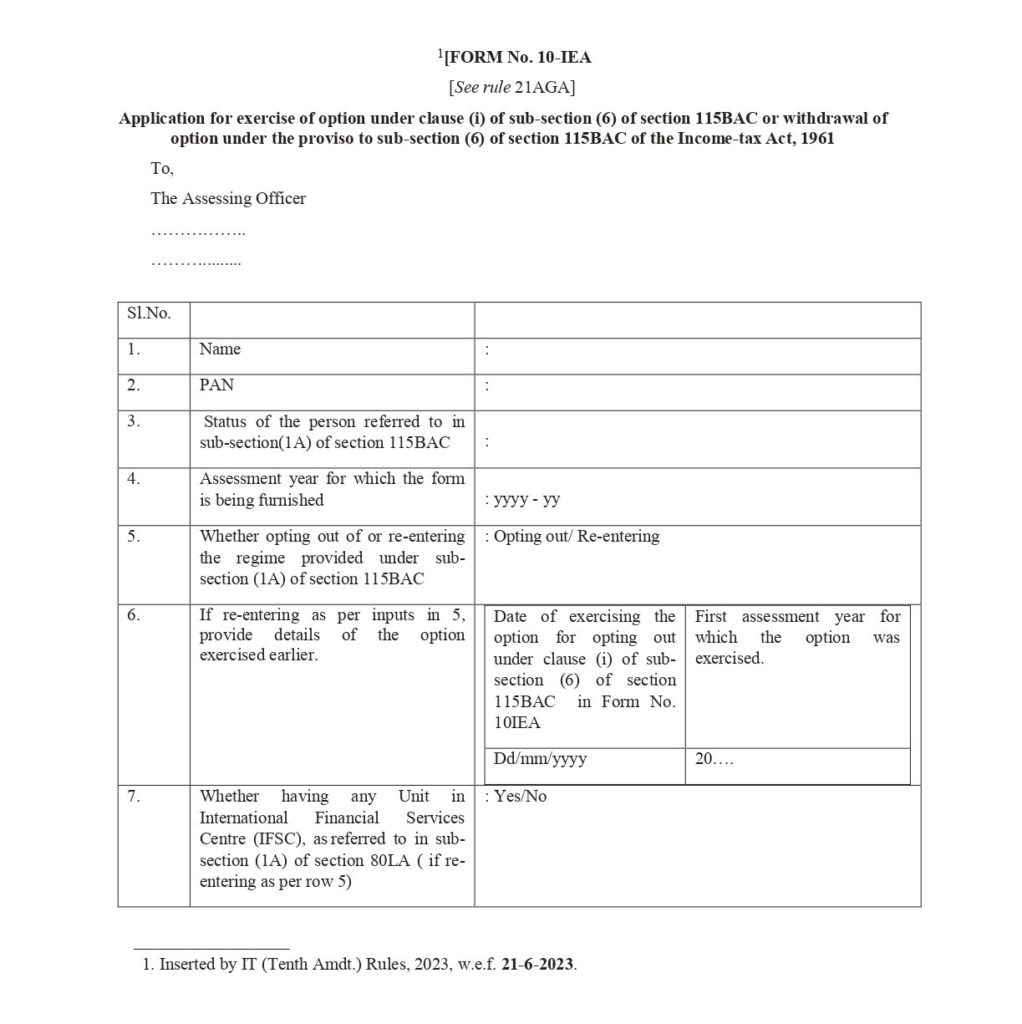

All the individuals who wish to choose the old tax regime, need to select the option specifically by going through the prescribed process. Form 10IEA is a newly introduced form that can be used by taxpayers to exercise their option to choose between the old regime or the new regime. By filling form 10IEA, the taxpayers can inform the income tax department of their choice regarding the tax regime.

What you need to know about Form 10-IEA:

Individuals are also required to specify the relevant dates from which they want to opt out or re-enter the new tax regime while filing Form 10-IEA. From FY 2023-24, the new tax regime has been set as the default tax regime. This means that if the taxpayer does not exclusively mention their intended choice of selecting the old regime, they will be automatically enrolled in the new regime.

Filing of Form 10-IEA is required to done by Individuals with business and professional income and hence individuals with no business or professional income are not required to fill this form differently as they have an option to choose the regime in the income tax form itself that they will be filing at the time of preparing income tax return.

Therefore, those persons who have income from business/profession, it is mandatory to fill Form 10-IEA to opt for the old regime before the ITR filing due date, i.e. 31st July.

Process to file form 10-IEA:

Form 10-IEA should be filed before due date of filing your income tax return. An acknowledgment number will be generated and provided to you after filing Form 10-IEA.

Filing of Form 10-IEA process is similar to that of earlier filing form 10 IE. Person who is filing form 10 IEA has to login to his income tax portal to file this form and enter the basic details as mentioned in the form 10 IEA. Form 10 IEA is yet to be launched on the e filing portal however the process to file remains the same. Form 10 IEA is expected to be live from 01st April, 2024.

Individuals should ensure proper verification and validation of the form at the time of submission of Form 10-IEA. The form has to be verified with either A Digital Signature Certificate or Electronic Verification Code. This signifies authentic and valid verification and helps maintain the integrity and authenticity of the information provided. If any person wishes to either opt out or re-enter in the new tax regime, he must file form 10 IEA itself as it is a mechanism provided to switch between old and new tax regime from AY 2024-25.

Following is the format of Form 10 IEA :

Conclusion:

Filing of form 10IEA is not mandatory for individuals without business or professional income. However, individuals with business or professional income must intimate to the department their intention to either opt out of or re-enter into new tax regime. From AY 2024-25 only form 10 IEA will be there in force as the new tax regime is going to be default tax regime. Individual not having income from business or profession can choose this option of switching from old regime to new or vice versa is available in the income tax form itself that they will be preparing at the time of filing income tax return.

Recent Comments