Taxbase Broadly covers following key Modules

- Advance Tax Computations

- Facility for online payments

- Income Tax Return computation, preparation and e-filing.

- Document Management System

- Dashboards for Income Tax and TDS

- Covers all aspects of TDS/TCS e-filing.

- Audit – covers regularly used audit reports along with e-filing.

- Movement of Shares – Portfolio management

- Financial Statements along with import from Tally

- Billing module

SALIENT FEATURES

Income Tax

- Income Tax computation for selected AY and alongside previous AY for quick comparison.

- Facility to import data from previous year.

- Facility to import data from 26AS, AIS/TIS, MOS, XLS templates.

- User Access rights for additional data protection.

- Warnings and Validations at various levels.

- Auto update data to partners accounts from the firm’s return.

- Old/New Regime of tax computation for comparison and tax savings

- Home grid search/filter facility on multiple criteria such as Name, DOB, Status, PAN, City, Auditor, City, filed ITR, In-process ITR or not started ITR along with print/ excel export.

- Auto populate of employee data in home grid from TDS module.

- Capital Gain facilitates selection of stocks and mutual funds along with ISIN code and FMV as on 31.1.2018.

- Group-wise income report to have overview of Income and Tax for a family.

DMS - Document Management System

- Separate folders for each member and respective AY.

- Separate folders for Income Tax and TDS

- Dashboard view of documents under each folder along with facility to save

TDS - Tax Deduction at Source

- Data capture through manual entry and/or through user friendly xls templates or through TDS conso files.

- Covers major aspects of TDS/TCS returns 24Q, 26Q, 27Q, 27EQ etc.

- Warning / Validations of data for potential errors

- Manages threshold levels for applicability of TDS.

- Caters to lower deduction of tax in certain cases along with applicable periods and applicable thresholds.

- Monthly/Yearly salary data entry

- Estimates income and tax in case of monthly data.

- Prepares challans along with interest computation and facilitates online payment of same through income tax portal.

- Facilitates sending of requests for form 16, 16A along with download and generation of the respective forms.

- Merging of Parts A and B for Form 16

- Digitally signing of single/bulk filing of forms such as Form 16/16A and dispatching of same through bulk mailing to respective payees.

- Facilitates revision of returns and submission of these to the income tax portal.

Audit

- 3CA/ 3CB/3CD

– Copy data from the previous year.

– Import of data from user friendly xls templates under various sections.

– Auto pick data from ITR or vice-versa for depreciation entries or import from xls.

– TDS compliance – import data from tds module or import from txt/ conso files.

– Validates and generates efile and upload to ITD portal. - CARO report, 3CEA, 3CEB, 6B….. many more

Get 30 days no obligation fully functional copy to Test Drive Speed combined with simplicity and technology

Movement of Shares (MOS)

- Supports shares, mutual funds

- Facilitates Investment, Trading or Day trading transactions.

- Updates daily rates with a click of button using API calls.

- Facilitates data look at your scripts of interest using various strategies.

- Generates host of reports including

- Profit chart over the period of the financial year.

- Scrip wise holding along with Script wise profit

- Short term/ Long Term profit booked/not booked

- Profit adjusted cost of scripts.

- All above reports may be generated for an individual or for multiple members or all members in a family.

- All above data is seamlessly imported in the capital gain section of the income tax module thus eliminating cost and error of double entry.

Financial Statements

- Maintains financial statements for a taxpayer.

- Imports data directly from tally.

- User-defined schedules.

- Print/export to xls options.

Billing Module

- Supports bills with or without GST along with print/ email.

- Receipts in advance or against bills along with print/ email.

- Credit and Debits notes.

- Maintains Outstanding/ ledgers for a member or group.

Dashboards for Income Tax/ TDS

Online Services

- ITR Dashboard – Quick update on ITR filing status on single/ multiple AY’s along with download of Acknowledgements in PDF format.

- Refund Status – update status of refunds for single/ multiple AY’s

- Intimations – Download intimations for single/ multiple AY’s along with intimation copy.

- E-proceedings – download notices (if any) across multiple AY’s.

- Defective return – quick update on status of ITR filed return if found defective.

TDS Dashboard

- Update and download acknowledgement receipts for a FY and all quarters for 26Q, 24Q, 27Q and 27EQ along with following information,

- Date of filing

- Acknowledgement number

- Status of filing etc.

Activity Center

- Quick Update on multiple Tax Payers or a group on

- If PAN Aadhar has been NOT linked

- If there are any demand outstanding across multiple years

- If there are any notices open from ITD.

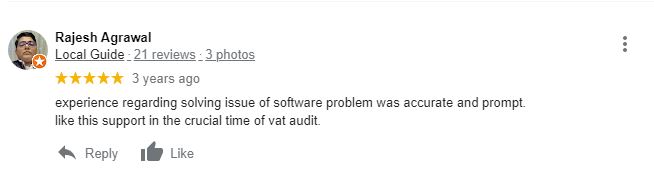

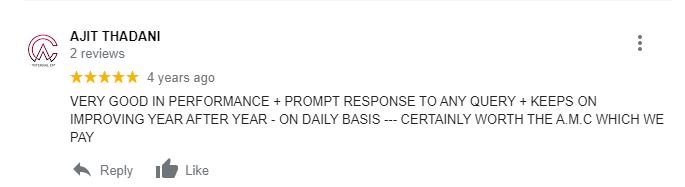

About us

Sinewave Computer Services Pvt. Ltd (ISO 9001-2015 certified) is 36 years old income tax, GST and HR solutions software development company situated in Pune, Maharashtra, India. Sinewave is well-known for providing high quality and reliable GST, TDS, Income Tax, and Payroll software solutions.

Need help? Call us on 020 49091000