Sinewave Computer Services Pvt. Ltd is among the top-notch income tax, gst, tds software development companies in India. Working for 36 years we are proficient in producing reliable, consistent, and high-quality income tax, TDS, and GST software for our valuable clients including but not limited to Chartered Accountants, Tax professionals, accountants, tax consultants etc., in India.

Our Taxation Software Solutions

TaxbasePro - ITR Software

TaxbasePro – This ultimate income tax software includes all the functions of a tax return as well as electronic filing, making it user-friendly, well-designed, and professional.

Taxbase GSTPro - GST Software

The advanced Taxbase GSTPro facilitates with its eye-catching features like, GST returns filing, return dashboard, input credit registers, and inward/outward supplies invoicing.

Taxbase TDSPro - TDS Software

TDSPro – High-quality TDS software designed by professionals of Sinewave aids to determine TDS payments. Super user-friendly with accurate results.

Paywhiz - Payroll Software

Paywhiz – A versatile employee payroll management software combined with taxation. Specially designed for MNCs, banks, BOPs, SMEs, and other instructions.

VATXpress - VAT Software

VATXpress – Professional VAT/MVAT software designed to compute VAT, E-payments, and E-filings. Helps businesses utilize customer-facing transactions.

TeamControl - Team Management Software

India’s Best Income Tax, TDS, GST Software For Your Business!

By offering advanced taxation services, we aim to assist people. With a focus on transforming tax computation, and filing Sinewave have been developing taxation software products for the Indian market we have a successful clientele of 30,000.

Managing Director

Neerja Moolani

Director

Executive Assitant

Rupesh Kale

Training Manager

Sales Manager

Why Sinewave?

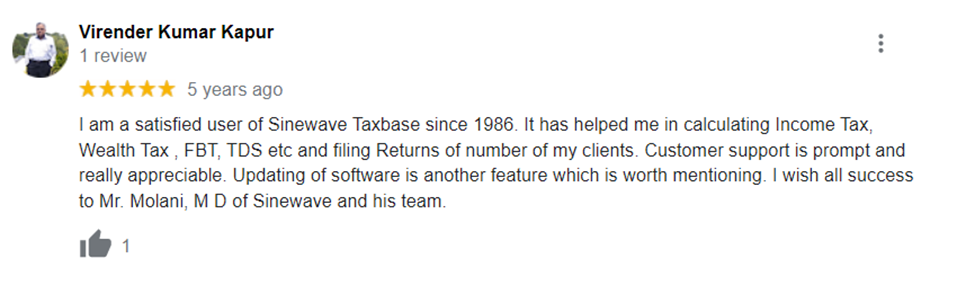

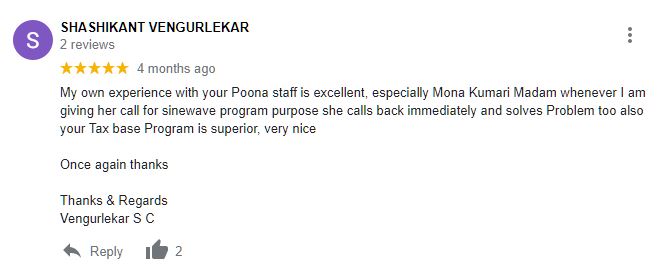

Sinewave Computer Services Pvt. Ltd is one of the most trusted taxation software provider companies in India with more than 30,000 clients. Our team of professional software designers and developers is skilled in making the best ITR, TDS, GST, and tax software for all organizations including banks, SMEs, offices, firms, business organizations, and educational institutions.